Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Becoming a landlord requires financial resources, good credit, time, knowledge, and hard work. Compared to buying stocks and bonds, it's much more hands-on form of investing.

The first issue to consider when buying an investment property is financing. You need money and lots of it. Forget about the radio ads you hear promising no-money-down solutions to real estate investing. That’s a myth. To play this game, you need a good credit score and at least enough cash to cover a 20 percent down payment, closing costs, insurance, as well as two months of mortgage payments, utilities, and property association fees.

Another prerequisite for buying an investment property is compiling the necessary paperwork. You will need a lease agreement and a rental application. You can go online and find samples to use as a starting point. You may want to have a real estate attorney review your lease agreement to make sure nothing's been left out.

Potential rental properties include single family homes, condominiums, townhomes, and multifamily units. A good choice for a first-time investor is a condominium or townhome. These represent the least amount of capital required, and not having a lawn is a plus. The typical progression for real estate investors is condo, single family home, multifamily unit – the latter being the most expensive.

You need to research the community where you plan to purchase a rental property, just as you would for your own residence. Have there been any lawsuits filed against the builder for water intrusion? How are the schools and the crime rate? How about curb appeal? Remember, you are buying the property as an investment; you want it to be worth more when you sell it someday.

Before renting out your investment property, you need to be prepared to perform background checks on prospective tenants. Experian Connect is a good resource for performing credit checks and Instant Checkmate is used for criminal background checks. These services are not free; you may want to charge a $50 nonrefundable fee for each adult listed on a rental application.

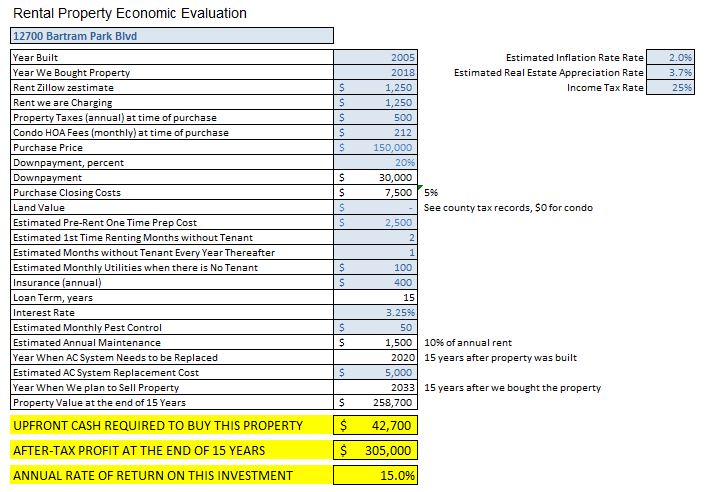

It's a good idea to calculate the potential return on investment for a rental property. This is done by taking the estimated periodic costs and income over the life of the investment and bringing them back to a net present value. Then, combine that amount with the first costs required to buy the property and calculate the return on investment based on the property value when it’s sold at the end of the investment period. In other words, if you took the money required to buy and maintain the rental property and put it into some type of fund or investment instead that yields the same return calculated for the rental property, at the end of the investment period you would end up with the same amount of money as you stand to gain by owning, renting, and eventually selling the rental property.

This can be done with a spreadsheet that takes into account the rate of inflation, real estate appreciation rate, income taxes, rent collected, mortgage payments, property taxes, property association fees, purchase price, down payment, closing costs, initial renovation cost, an estimate of the time required to obtain your first and all subsequent tenants, utility costs when the property is vacant, property insurance, mortgage term, interest rate, pest control, annual maintenance, cost of replacing the cooling/heating system every 15 years, and investment period. Here’s an example:

As you can see, the return on investment in the example is 15 percent. You might say, there are mutual funds out there with a better return than that. True, but how many of them return 15 percent year after year for 15 years straight?

This is not a complete analysis, other considerations include annual depreciation for tax purposes and depreciation recapture tax when the property is sold.

Adding real estate to your retirement portfolio will help diversify your assets and provide a hedge against volatility in the stock market. It’s not for everyone, it requires a lot of work and putting up with some amount of aggravation. If you are unsure about whether becoming a landlord is right for you, it would be wise to thoroughly research the matter before you take the plunge.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.